Gift deed Vs Will, Which Is Better for Property Transfer?

Gift Deed Vs Will in Chennai 2025? Compare stamp duty, legal validity, Patta transfer, tax rules & dispute risks for smooth property transfer in Tamil Nadu.

ARTICLES

Venshan

12/9/20254 min read

Transferring property in Tamil Nadu involves making a key decision: Should you pass it through a Gift Deed or a Will?

Both are legally valid, but the implications differ sharply in terms of ownership transfer, taxation, stamp duty, revocability, and legal challenges.

This guide explains the difference in simple terms, helping homeowners in Chennai and across Tamil Nadu choose the right option.

What Is a Gift Deed?

A Gift Deed is a legal document used to transfer property from one person (Donor) to another (Donee) during the lifetime of the owner with no monetary exchange.

Key Features

Transfer happens immediately

Irrevocable once registered

Beneficiary gains full ownership instantly

Can be used for residential, commercial, or land property

Common Use Cases in Chennai

Parents gifting house/flat to children

Siblings transferring inherited shares

Grandparents gifting property to grandchildren

Spouses gifting property for financial clarity

What Is a Will?

A Will is a legal declaration specifying who will inherit the property after the death of the owner (Testator).

Key Features

Effective only after the owner's death

Can be modified anytime

Low drafting cost

Requires probate in some cases (especially when disputes are expected)

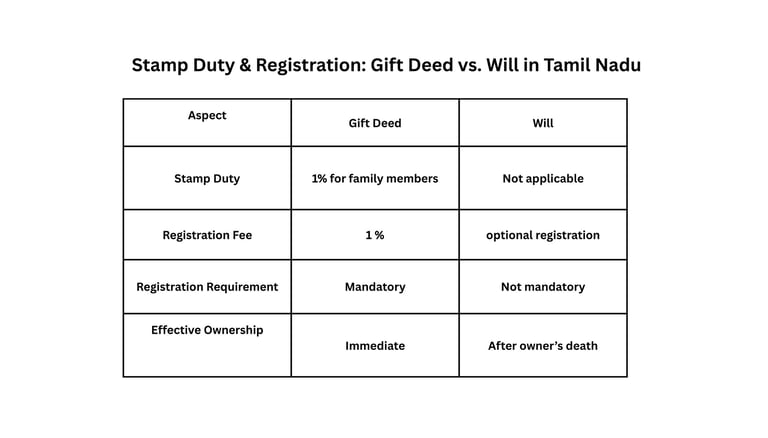

Stamp Duty & Registration: Gift Deed vs. Will in Tamil Nadu .

Who Are Considered Family Members for Stamp Duty Concession?

In Tamil Nadu, concession applies when gifting to:

Spouse

Children

Grandchildren

Parents

Siblings

If gifting outside family, normal stamp duty is charged (around 7% + fees).

When Should You Choose a Gift Deed?

A Gift Deed is suitable when:

You want immediate transfer of ownership

You wish to avoid future disputes

You want to pass property while you are alive

You prefer clear title and smooth mutation (Patta name transfer)

Benefits of Gift Deed

Instant ownership transfer

Donee can sell, lease, or mortgage the property right away

Lower stamp duty within family

Useful for estate planning without delay

Drawbacks

IRREVERSIBLE after registration

If relationship breaks, property cannot be taken back

Immediate tax implications if gifted to a non-family member

When Should You Choose a Will?

A Will is ideal if:

You want control over the property until death

You want flexibility to change names anytime

You have multiple beneficiaries and need future adjustments

Benefits of Will

Low cost

Amendable anytime

Allows division among heirs

No stamp duty or immediate tax

Drawbacks

Takes effect only after death

Can be challenged legally

Probate may be required (especially for Chennai urban property)

Property transfer may get delayed due to disputes

Probate Requirement in Chennai (Important)

In Chennai, probate of Will becomes necessary when:

The Will deals with immovable property within Chennai limits

Multiple heirs may contest the Will

Original Will has unclear or disputed clauses

This process can take 6–18 months, depending on objections.

Who Are Considered Family Members for Stamp Duty Concession?

In Tamil Nadu, concession applies when gifting to:

Spouse

Children

Grandchildren

Parents

Siblings

If gifting outside family, normal stamp duty is charged (around 7% + fees).

When Should You Choose a Gift Deed?

A Gift Deed is suitable when:

You want immediate transfer of ownership

You wish to avoid future disputes

You want to pass property while you are alive

You prefer clear title and smooth mutation (Patta name transfer)

Benefits of Gift Deed

Instant ownership transfer

Donee can sell, lease, or mortgage the property right away

Lower stamp duty within family

Useful for estate planning without delay

Drawbacks

IRREVERSIBLE after registration

If relationship breaks, property cannot be taken back

Immediate tax implications if gifted to a non-family member

When Should You Choose a Will?

A Will is ideal if:

You want control over the property until death

You want flexibility to change names anytime

You have multiple beneficiaries and need future adjustments

Benefits of Will

Low cost

Amendable anytime

Allows division among heirs

No stamp duty or immediate tax

Drawbacks

Takes effect only after death

Can be challenged legally

Probate may be required (especially for Chennai urban property)

Property transfer may get delayed due to disputes

Probate Requirement in Chennai (Important)

In Chennai, probate of Will becomes necessary when:

The Will deals with immovable property within Chennai limits

Multiple heirs may contest the Will

Original Will has unclear or disputed clauses

This process can take 6–18 months, depending on objections.

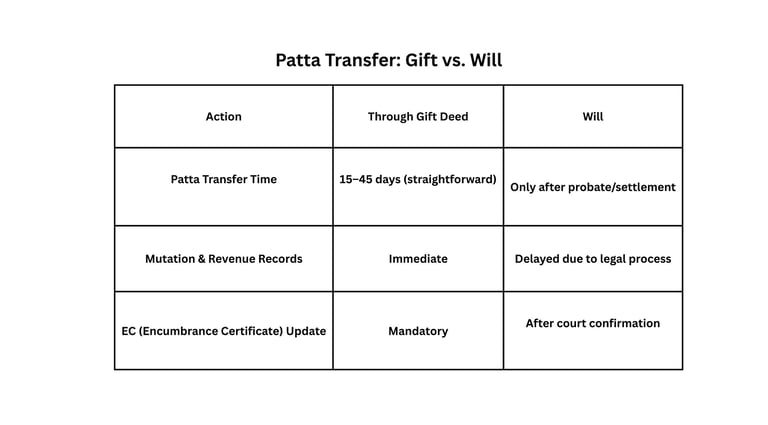

With a Gift Deed, EC, Patta, and revenue records update quickly.

With a Will, updates happen only after death + probate.

Which Has More Legal Security in 2025?

If there is a possibility of dispute in your family, Gift Deed is legally stronger because it:

Transfers ownership while you are alive

Eliminates claims after death

Cannot be contested like a Will

Will documents, while valid, are more prone to:

Challenges

Court disputes

Probate delays

Tax Impact in Tamil Nadu

Gift Deed

Property gifted to family members is exempt from tax

Gifts to non-family are taxable as per market value

Will

No tax at the time of inheritance

Tax applies only when the property is sold by the beneficiary (Capital Gains)

Conclusion

In Chennai and Tamil Nadu, both Gift Deeds and Wills are valid instruments for property transfer.

However, the choice depends on your priorities:

If you want smooth, quick, and dispute-free transfer, choose a Gift Deed.

If you need flexibility and control till the end, choose a Will.

Before executing either, consulting a real estate documentation expert in Chennai ensures compliance with stamp duty, Patta transfer, EC records, and registration procedures.

FAQ

1. What is better for property transfer in Chennai—Gift Deed or Will?

A Gift Deed is better for immediate transfer and dispute-free ownership. A Will is suitable if you want control until death and flexibility.

2. How much is stamp duty for Gift Deed in Tamil Nadu?

Stamp duty is 1% for gifting to specified family members. For non-family members, standard duty (approx. 7%) applies.

3. Does a Will require probate in Chennai?

Yes, in most Chennai urban property transfers, probate is required before beneficiaries can claim ownership.

4. Can a Gift Deed be cancelled after registration?

No. Once registered, a Gift Deed is legally irrevocable unless proven fraud or coercion in court.

5. How long does Patta transfer take after Gift Deed?

Usually 15–45 days, whereas a Will transfer may take months due to probate.